Reuters today claim that British security officials have told UK telecom operators to ensure they have adequate stockpiles of Huawei equipment due to fears that new U.S. sanctions will disrupt the Chinese firm’s ability to maintain critical supplies.

Britain granted Huawei a limited role in its future 5G networks in January, but Prime Minister Boris Johnson has since come under renewed pressure from Washington and some lawmakers in his own party who say the company’s equipment is a security risk. Huawei has repeatedly denied the allegations.

Officials at the National Cyber Security Centre (NCSC) are now studying the impact of U.S. measures announced in May, which are intended to restrict Huawei’s ability to source the advanced microchips needed to produce its 5G equipment and flagship smartphones.

Senior NCSC officials wrote to operators including Britain’s BT Group and Vodafone last week, said three people familiar with the matter, telling them to maintain adequate supplies of spare parts from all manufacturers.

But the letter also emphasised the increased risk to Huawei’s equipment and its future ability to provide updates for those products in the face of U.S. pressure.

“Ensuring that products and components are kept up-to-date is essential to maintaining the security of networks,” the letter said. “Escalating U.S. action against Huawei may affect its ability to provide updates for products containing U.S. technology.”

An NCSC spokeswoman said: “The NCSC has provided operators with a series of precautionary steps we recommend they take while we carefully consider the impact these sanctions have on the UK’s networks.”

Huawei Vice President Victor Zhang said: “Our customers are our number one priority and we are working with them to ensure business continuity. We strongly oppose politically-motivated actions by the US that are designed to damage our business and are not based on evidence.”

BT and Vodafone declined to comment.

Britain designated Huawei a “high-risk vendor” in January, capping its 5G involvement at a 35% market share and excluding it from the data-heavy core of the network.

Is it time to look at investing in the main benefactors to a block of Huawei?

The global telecoms equipment market for network operators is dominated by three global players – Huawei, Ericsson and Nokia. Other players include Samsung, CISCO, Juniper, Ciena and ZTE.

In the UK, there is a high concentration in certain market segments and the leading players are also Huawei, Ericsson and Nokia. These firms supply the main UK mobile operators and have the ability to provide end-to-end network equipment.

Huawei is the leader in the 4G mobile access market in the UK. It has the highest market share in this segment at c.35% overall. It is also the leader in fixed access in the UK.

Huawei faces competition mainly from Nokia and Ericsson in the UK mobile and fixed access equipment markets, although the latter does not have a strong position in the fixed access market. Ericsson is also active in the mobile core market while Nokia is also active in both the mobile and fixed core markets. Samsung has a limited presence in the provision of mobile and fixed network equipment in the UK.

Learn more about the UKs position on the Telecom Supply Chain by reading the latest Report from the Dept of Digital, Culture, Media and Sport at UK GOV.

We see both Ericsson and Nokia as the key benefactors in the battle with replacing Huawei as the UK and others fold to US pressure.

Nordic winners

Strange how the two largest players in the telco space are based close-ish together in Sweden and Finland. Both companies have had ups and downs over the years.

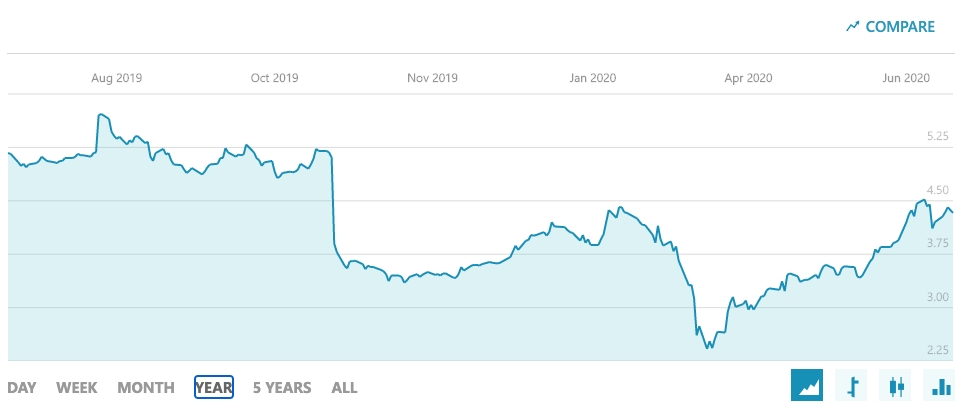

Below are the last years stock price for each firm.

Nokia:

Nokia Corporation revenues grew 3.33 % in FY 2019 as compared to FY 2018 to 23.32B. Net income grew 102.06 % to 7.00M. Market Cap 25B.

Learn more at corporate website.

Ericsson

Revenues grew 7.77 % in FY 2019 as compared to FY 2018 to 227.22B. Net income grew 134.04 % to 2.22B. Market Cap 31B

Learn more at corporate website.

About us and this blog

We are a digital marketing company with a focus on helping our customers achieve great results across several key areas.

Request a free quote

We offer professional SEO services that help websites increase their organic search score drastically in order to compete for the highest rankings even when it comes to highly competitive keywords.